What is the new “Mansion Tax” being imposed in 2023? Whether you agree with it or not, in this past 2022 election cycle, Los Angeles voters passed Measure ULA and Santa Monica voters passed Measure GS. The purpose of these measures is to generate funding to address the unhoused problem in these cities and also help those with housing insecurities.

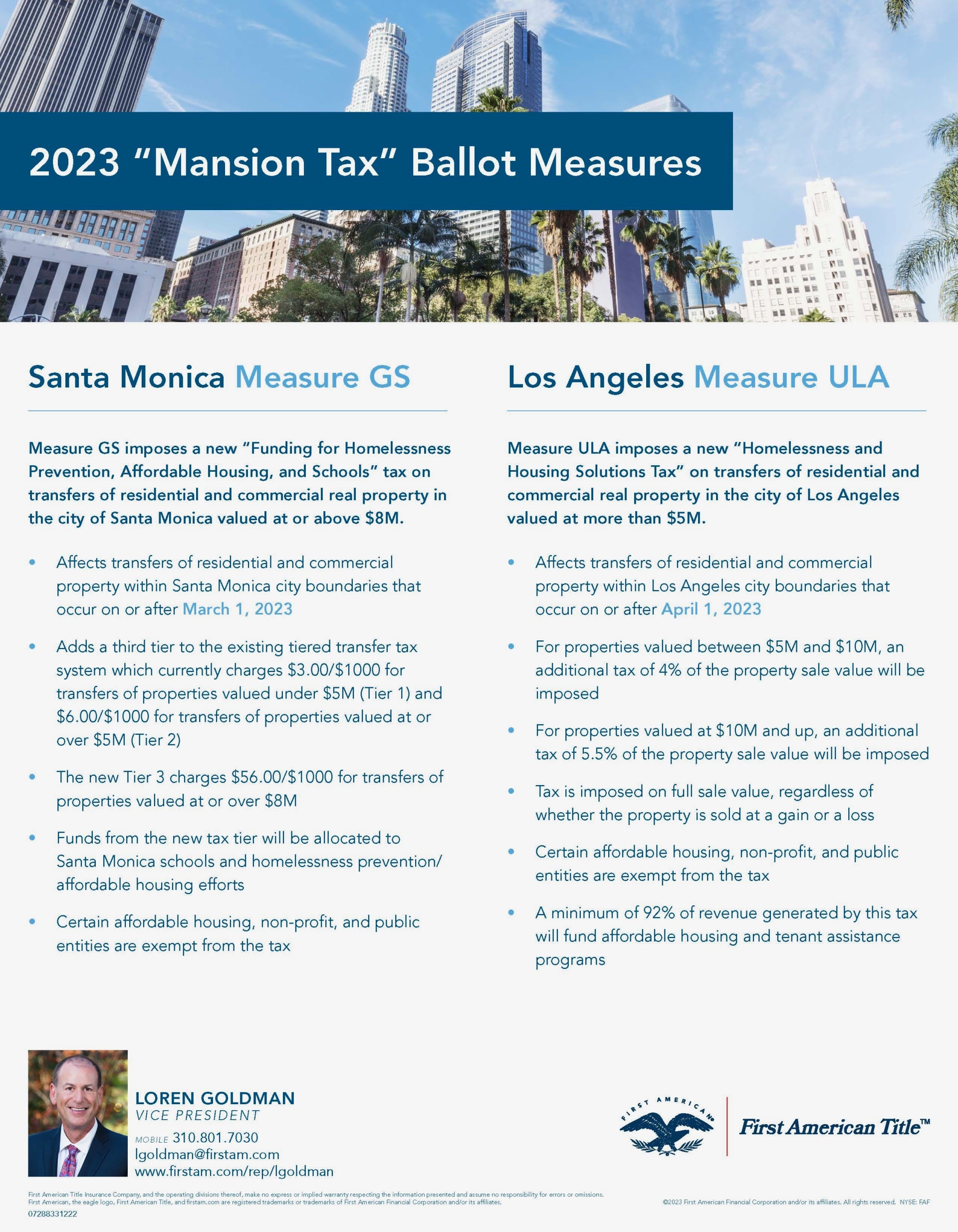

ULA adds an additional transfer tax on sales of residential and commercial properties valued at more than $5,000,000. GS does the same for properties valued at more than $8,000,000. Measure ULA passed 58% to 42%, and Measure GS passed 53% to 47%.

Measure ULA in LA specifically enacts a 4% tax on properties sold or transferred for more than $5 million and a 5.5% tax on properties sold or transferred for more than $10 million. It establishes the House LA Fund within the city treasury to collect the additional tax revenue. It also allocates revenue to projects that address housing availability at certain income thresholds and homelessness prevention. The House LA Fund is a separate fund so the monies raised do not go into the general fund, which means the funds cannot be used for any other purposes other than the goals outlined in the measure.

Measure GS in Santa Monica adds a new tier to the existing transfer tax system by charging $56.00/$1000 for transfers of properties valued at or over $8,000,000.

Those that voted for the passage of these measures were surely drawn to the goals of providing funding to get the unhoused off the streets and to assist those with housing insecurities. Housing insecurity is when a person does not have stable living arrangements, mainly due to threat of eviction or living in unsafe conditions. The feeling is that any seller of a property valued at $5,000,000 or more can surely afford to pay this additional tax. Also, sellers of properties at those valuations should pay their fair share towards helping getting the unhoused of the street.

However, sellers of those properties beg to differ. The tax is assessed at the sales price so it’s the same whether the property is free and clear or mortgaged. If a property has a high loan to value ratio, the seller may have to go into pocket to pay this additional tax. The repercussions could be sellers deciding to hold onto properties and leasing them out instead. Or for a housing developer, if being subject to the tax means they will not be able to make the necessary profit to move forward with the construction then it will only contribute to the problem of not enough housing being built.

There are strong feelings on both sides of the issue. Ultimately, anything that leads to more affordable housing being built is a good thing for both Los Angeles and Santa Monica. See flyer below for details. Thank you to Loren Goldman from First American for the information.

Cover Photo by R ARCHITECTURE on Unsplash